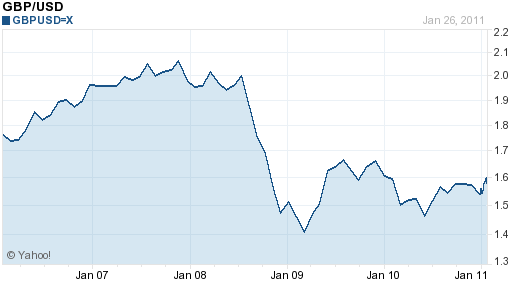

As politicians, executives and financiers networked at parties and panels last week in Davos, Switzerland, Barrie Wilkinson was in a nearby hotel, warning that a 2015 financial catastrophe may be looming.

“The fundamentals haven’t been addressed at all,” Wilkinson, a London-based partner at consulting firm Oliver Wyman, said in an interview at the Hotel Morosani Schweizerhof. “The things that caused the previous crisis -- loose monetary policy and trade imbalances -- they’re actually bigger now than they were then.”

In the caste system of the World Economic Forum’s annual event in the Swiss ski resort, Wilkinson was at a bottom rung, with an identification badge that denied him access to most sessions and soirees. His message clashed with the optimistic tone of many at the center of the meeting, who were eager to emphasize the progress made after two years of hand-wringing in the wake of the 2008 financial crisis.

“The systemic reforms that have been accomplished are significant,” Canadian Finance Minister Jim Flaherty said as he left a private meeting with finance company chief executive officers on Jan. 29. “We need to communicate better that financial institutions globally are operating on a very different basis today, that they are operating with higher capital and are better regulated.”

‘An Avoidable History’

Wilkinson’s report, titled “The Financial Crisis of 2015: An Avoidable History,” isn’t so sanguine. The 24-page study describes how banks, unwilling to accept the lower returns on equity, or ROEs, that result from higher capital requirements, may fuel a new bubble by chasing high returns in commodities or emerging markets. Regulators, by focusing their restraints on banks, may drive risk-taking into unregulated funds that also pose danger to the system.

The report urges bank executives and shareholders to accept that returns of the past are unsustainable and that they need to do a better job of monitoring risks, especially in areas that produce unusually high profits.

“Banks need to be less leveraged,” said Wilkinson, 38, who has an engineering degree from the University of Cambridge’s Trinity College and has worked since 1993 at Oliver Wyman, where he focuses on risk management. “The true test for me of whether they’ve deleveraged is if the industrywide ROEs come down. If they don’t, I’m very suspicious that there are hidden risks in the system.”

UBS Advice

Oliver Wyman, a subsidiary of New York-based Marsh & McLennan Cos., played a role in the last financial crisis. The firm’s strategy consultants advised UBS AG’s fixed-income unit, which was lagging other divisions in early 2007, to invest in U.S. mortgage securities and collateralized debt obligations to boost returns, according to a review submitted by UBS to Switzerland’s federal banking commission in April 2008. Those investments helped fuel almost $58 billion in losses and writedowns at the Zurich-based bank.

After the 2008 crisis, governments and central banks spent unprecedented amounts of taxpayer money to bail out the financial system. Part of Wilkinson’s concern is that if the system is allowed to return to its old boom-bust habits, debt- strapped governments may not be able to handle the fallout of another crisis, either financially or politically.

“If there is another banking crisis, the Western governments are just in no shape to stabilize the system, they’ve expended their entire arsenal on the last round of fiscal injections,” Wilkinson said.

‘Incipient Sovereign Crisis’

The same theme pervaded a World Economic Forum dinner on Jan. 28 that discussed what would happen if a big bank were allowed to fail. The group, which included Nomura Holdings Inc. Chief Operating Officer Takumi Shibata, 58, former Italian Finance Minister Domenico Siniscalco, 56, and ING Groep NV CEO Jan Hommen, concluded that governments have no choice but to come to the rescue of any failing multinational megabank because there is no system to handle a controlled failure.

If a government was unable to save such a bank, the contagion and damage could be severe.“I came into this dinner somewhat pessimistic and worried about the assignment we are here to discuss,” Simon Johnson, a professor at the Massachusetts Institute of Technology’s Sloan School of Management and a Bloomberg News columnist, said halfway through the evening. “I am now terrified. There is an incipient sovereign crisis here mixed in with the bank crisis.”

Dimon, Dell

Financiers at Davos this year weren’t talking much about future returns on equity or potential bubbles. Instead they were holding parties and meeting clients. JPMorgan Chase & Co. CEO Jamie Dimon, 54, hosted guests including Bank of Canada Governor Mark Carney and Dell Inc. founder Michael Dell, 45, at a reception one night. He was out late the next night with hedge- fund manager Louis Bacon, 54, and other guests at a party hosted by Google Inc.

Siniscalco, who now leads Morgan Stanley in Italy, said he had about 35 meetings in Davos this year compared with 15 last year. The co-head of investment banking at one firm was overheard telling someone on his mobile phone that he’d lined up five mandates.

“In Davos, there’s a lot of optimism here, and I’m quite surprised by it, especially from corporate CEOs,” said Tarun Jotwani, CEO of Europe, the Middle East and Africa and global head of fixed income at Nomura. “It is against a backdrop of potentially the biggest macroeconomic public-finance mismatches that I’ve ever seen in my career.”

Pushing Risk-Taking

When bankers weren’t trying to win business, they were worrying about governments’ fiscal policy in the U.S. and Western Europe or reiterating the role that finance plays in economic growth. And they echoed one element of Wilkinson’s report -- the part that said a focus on bank rules could push risk-taking into hedge funds or other types of financial companies that don’t fall under the regulations.

While German Chancellor Angela Merkel said on Jan. 28 that too little had been done to prevent another financial crisis, politicians focused mostly on defending their efforts to restore growth, curb inflation and deal with the debts of European countries such as Greece and Ireland. As French Finance Minister Christine Lagarde told a panel on Jan. 29, “the euro zone has turned the corner” and “we learned from our mistakes and we learned from the crisis.”

Closed-Door Meeting

U.S. Treasury Secretary Timothy F. Geithner, Bundesbank President Axel Weber and Spain’s finance minister, Elena Salgado, also spoke to a private gathering of some of the world’s top investors, including hedge-fund and private equity fund managers, according to two people who attended the meeting. The officials sought to assure the money managers that their policies would lead to growth and prevent a crisis in Europe.

When bank CEOs including Bank of America Corp.’s Brian Moynihan, Deutsche Bank AG’s Josef Ackermann and Barclays Plc’s Robert Diamond held a closed-door meeting with politicians and central bankers on Jan. 29, the tone was conciliatory.

The main topics were the need to improve international coordination and to better oversee the non-bank parts of the financial system, said Howard Davies, chairman of the London School of Economics and a former chairman of the U.K.’s Financial Services Authority.

“There was a very positive mood about what had been done so far,” said Davies, who is also a board member of New York- based Morgan Stanley and London-based insurance company Prudential Plc. “It was quite an upbeat session.”

Source: Bloomberg By

Read More......